By Ken Krivacic, OD, MBA

Tracking and managing your cost of goods is a key to practice profitability. Good planning lets you supply patients with the products they need and profit from your inventory investment.

You may know roughly what you need in inventory such as contact lenses, frames and medical supplies, but how close to exact is your knowledge of these needs? On-target budgeting for your cost of goods makes the difference between having what you need to serve patients and making a profit and falling short or running into an overstock problem. Here is how I budget for my COG and what doing so has meant to my profitability over time.

Itemize Your COG

COG (Cost of Goods) is defined as anything that is purchased by the office with the intent of reselling. In most optometric practices this would include frames, lenses for frames, sunglasses, eyeglass cases, eyeglass accessories, contact lenses, contact lens accessories and medical supplies. In our office we define medical supplies as contact lens solutions, eye drops that are sold (usually for dry eye) and vitamin supplements.

Since we have our own edging lab, we include the salary of our lab tech whose full-time job is to cut and edge. For budget purposes this can either be included in COG or in employee salaries depending how the individual office prefers to track it. Just make sure you are consistent in which category you use throughout the year.

COG Have a Huge Impact on Net Profit

Just as it is important to budget for all expenditures in an office, COG is at the top of the list in most offices as a majority of income and expense is in this category. Most offices that have an optical typically garner close to 50 percent of all income from the sale of goods in the optical department. Jointly, COG is usually the largest category in the budget. According to Jerry Hayes, OD, the recommended range of expenses related to COG should be from 27 percent to 33 percent of total income. It is, therefore, very important to the bottom line that expenses stay within budget. If it is too high then the extra monies impact the other areas of a practice. In most cases, the largest effect is on net profit.

We may think that net profit is only what the ownerdoctor takes home, but it has other side-effects. If net is reduced, cash flow is impacted making it harder to pay bills in a timely manner. A reduced net also affects the office’s ability to purchase new goods and new equipment. It could also impact the ability of the office to upgrade, remodel and pay commensurate salaries.

Watching our budget every month, we were able to keep our COG for 2012 at 28.8 percent. This was done by monitoring a monthly budget report and sharing the numbers with the staff to help maintain the desired range. In COG this impacts how we price products, how much product we carry, and how often we reorder. Without consulting a budget, all those processes would be done virtually blind of how it would affect the entire budget, and therefore, the bottom line.

Beginning of Year (i.e. Now!) Is a Good Time to COG Budget

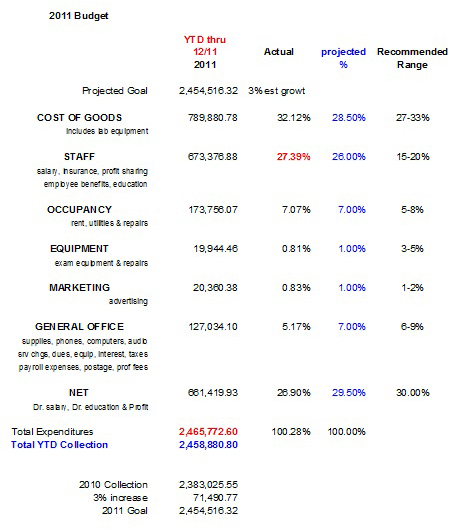

The process for us starts at the beginning of the year. I start with the budget from the previous year and project based on what I feel we can grow for the coming year. Since we are a longstanding office (30+ years) and rather large (close to 2.5 million in revenue in 2012) I estimate our growth rather conservatively at 3 percent per year. This estimate is plugged into an Excel spreadsheet and the projected numbers are used to establish our budget for the upcoming year. This will vary office-to-office depending on length in business and size of practice. Younger and smaller offices will have more room to grow and estimates can be ratcheted up. You may also want to factor in local and national economic outlooks, though personally I tend to focus more on the capability of the office to determine what growth can be.

After the budget is established, I share it with not only the office manager but the entire staff. We have a bi-annual company retreat designed for this purpose so that everyone is onboard and working for the same goal.

Try for Yearly Time Frame in COG Budgeting

The time frame for the budget is a yearly time frame. Most companies have a yearly plan and we tend to follow that guideline. From there we track the budget monthly to ensure we stay on course.

Sometimes things can go astray. Last year, for example, we noticed that by the end of the year our COG had crept past 35 percent. To be honest, most of that falls on me as practice owner for not being proactive and addressing the problem sooner. In our case, after several meetings with the office manager and the optical manager we discovered that we had been over-purchasing frames in our optical department and had a rather large back stock of frames. In order to alleviate the situation we simply put a hold on further purchases until the back stock was reduced. Had we not had a budget at all, or not used it (our situation for several months), the problem would have slowly grown undetected until cash flow may have become a problem.

Leave a Little Flexibility in Budget for Unforeseen

I feel you have to start with a budget somewhere. After all, a budget is only a projection of what you want to happen or what you expect to happen. It is not an exact science. Nobody can predict the future and there are many situations that occur throughout a year that can throw you off course. The only thing you know for certain is how you performed last year and this naturally would be your starting point for the next year. You may want to alter the budget slightly based on things you think may happen such as adding another doctor or expanding your space. I would caution not to try to predict too much initially. It is far easier to amend the budget as you proceed through the year, but also keep your original projections as a barometer.

Implement Your COG Budget Formula

We keep our COG budget formula simple by trying to keep our COGs between 27 percent and 33 percent of total income. We have used this projection for years and it is a reasonable number to expect for most optometric practices. By looking at our previous years this can be further divided down to contact lenses (16 percent), frames (7.5 percent), lenses (5.7 percent), and medical supplies (0.2 percent). From the past we extrapolate into the future by plugging those percentages into a formula of expected growth in order to arrive at a budget for the upcoming year. See following chart as illustration:

Click HERE for an easy-to-read PDF of the following chart

Note COG Budgeting Shortfalls from Previous Year

In the past we had not done a very good job of tracking overstocks in our office. I left that up to our optical manager and assumed it was being watched. When we noticed our COG number getting high, we did some research and noticed our frame inventory had grown to close to 1,200 frames with about 150 of those housed in back stock. That’s when we met with the optical manager to discuss the situation and suggested we not order more frames until the back stock was reduced. It was our goal to have about 1,000 frames in stock. This could have gone undetected much longer had we not monitored our COG budget.

Make COG Budgeting Part of Practice Protocol

We now meet monthly with the heads of the different areas of the practice to share the projections from the budget and to make sure we monitor monthly as to not get too out of line. In the past we had relied on our bi-annual meetings to share this information, but monthly monitoring seems to be more effective.

COG Budgeting: Action Plan

Have a COG budget. Too many practices go through the year without a plan or guideline and then only react when things go bad. You should have a budget and you should write it down.

Keep it simple. Trying to get too detailed can be frustrating and time-consuming. If it’s too hard to track all the categories you’ll get frustrated and not continue. It’s better to at least track a lump sum category than not track at all.

Share your budget and your vision with your staff. You cannot do it all without help. You’ll be surprised at how much staff appreciate this and are willing to help keep the office on budget.

Monitor monthly. Letting things slip can either lead to more apathy and slippage or cause larger problems in the future. Monitoring monthly can also help you recognize trends.

Don’t overreact. Even though you monitor monthly, keep in mind that it is also a long-term project. Purchases in one month may take months to sell. Not every frame you buy is going the sell immediately. Look at the big picture. Monthly is great to look for trends. Yearly is a more realistic depiction of what is going on.

Related ROB Articles

Institute a Pricing Strategy to Maximize Profitability

End-of-Year: Assess Finances and Plan for a Profitable New Year

Increase Revenue-Per-Exam to $600

Ken Krivacic, OD, is the owner of Las Colinas Vision Center in Irving, Texas. To contact him: kkrivacic@aol.com.