All Adam Cmejla Articles

-

615Staff Management

615Staff ManagementAn Easy Way to Rein In Your HR Challenges

An option you may not have considered to address HR challenges.

-

378Finances

378FinancesHow the Corporate Entity You Choose for Your Practice Impacts What You Pay in Taxes

The ramifications of the corporate entity you choose.

-

1.7KFinances

1.7KFinancesThe Practice Retirement Plan Add-On with Significant Potential Tax Advantages

Complementary retirement plan with potential tax savings.

-

1.4KFinances

1.4KFinancesHow Best to Grow the Cash You Choose to Keep in Your Practice

Maximizing the cash you are keeping in your practice.

-

1.6KFinances

1.6KFinancesHow to Use Debt Responsibly In Your Practice When Interest Rates Are High

Ensuring your practice debt is ultimately beneficial.

-

1.6KFinances

1.6KFinancesTaxes: 3 Errors & 1 Improvement to Save You Significant Money

Ensuring you aren't leaving the IRS a tip.

-

3.2KFinances

3.2KFinancesHow Much Should I Pay Myself in W-2 Salary to Optimize SS Tax Savings Benefits?

Maximizing social security tax benefits & personal savings.

-

2.1KFinances

2.1KFinancesA Hierarchy of Where Practice Owners Should Invest Savings

Your many investment options for building wealth.

-

6.8KFinances

6.8KFinancesWhy Selling to PE Could COST You Six Figures

Why that PE deal may not be as juicy as it seems.

-

2.1KFinances

2.1KFinancesWhat Are Your Revenue-Producing Activities? Here’s How to Determine What to Delegate.

Knowing where you're most needed & where you can delegate.

-

1.8KFinances

1.8KFinancesDo You Have an “Intentional” Practice? How to Find Out & Why It’s Important.

Creating a practice that helps you fulfill your personal goals.

-

2.8KFinances

2.8KFinancesPiloting Your Finances: How to Ensure a Profitable Landing for Your Practice

Long-term financial planning that ensures a profitable outcome.

-

3.6KFinances

3.6KFinances4 Ways to Increase the Pre-Sale Value of Your Practice

Implementing a strategy to increase your practice's value.

-

1.9KFinances

1.9KFinancesThe Potentially Huge Impact of Switching from a SIMPLE IRA to a 401(k)

Why a 401(k) is a better option than a SIMPLE IRA.

-

4.4KFinances

4.4KFinancesStay Independent or Sell to PE? A Financial Analysis to Help You Decide.

Financial calculations to help you make a critical decision.

-

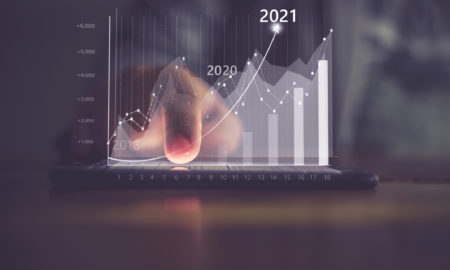

5.3KFinances

5.3KFinancesAmerican Rescue Plan Act of 2021: How ODs Will Be Impacted & How to Optimize the New Law

How ODs can optimize the American Rescue Act of 2021.

-

3.5KFinances

3.5KFinancesA Financial Analysis to Do Before Buying or Building Practice Real Estate

An important action to take before buying real estate.

-

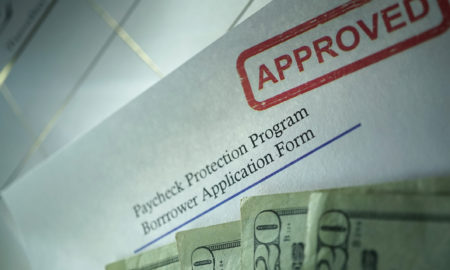

4.7KNews Briefs Archive

4.7KNews Briefs ArchiveCOVID-19 Stimulus Bill: How it Affects ODs

Impact of the new stimulus package on ODs.

-

5.1KFinances

5.1KFinancesPPP Long-Term Impacts: What We Still Don’t Know

Managing PPP loans, including how to handle the current uncertainty.

-

5.1KFinances

5.1KFinancesTax Strategies to Benefit From–and Exercise Caution Before Trying

Tax deductions that can help or hurt you--if not used judiciously.

-

5.3KFinances

5.3KFinances3 Tips for Tax Planning During COVID-19 from a Certified Financial Planner

Insights into maximizing your tax advantages.

-

7.2KFinances

7.2KFinancesMaximizing the Benefits of Your PPP Loan: Tips from a Certified Financial Planner

PPP loan management tips from a financial expert.

-

13.2KFinances

13.2KFinances5 Tips to Make Pretesting an Eye Health AND Practice Profitability Winner

Making pre-testing better for patients and practice.

-

7.9KFinances

7.9KFinancesFinancial Intelligence Insights

Tips on all aspects of financial management to improve your profitability.

-

6.1KFrames

6.1KFramesThe Test That Will Help You Determine Ideal Frame Pricing

Tips to help you profitably price frame inventory.

-

7.1KFinances

7.1KFinancesWhy (and When) It’s OK to Stop Focusing on Practice Growth

A new perspective on practice growth.

-

3.9KFinances

3.9KFinancesNew Tax Deduction: What to Do Differently Next Year

How to make the most of a new tax deduction.